Fintech Green Shoots Offer Hope to Many Startups

Prospects are brighter, but those considering an IPO should exercise caution.

May 16, 2024

(Bloomberg Opinion/Paul J. Davies) — The fortunes of Silicon Valley startups rose and fell together like never before in recent years. Partly that was due to the indiscriminate tidal wave of money that washed through venture capital, but it's also because many business-to-business software startups are closely connected as each other's customers.

Brex Inc., a $12.3 billion San Francisco-based firm, epitomizes that trend as one of several fintechs whose customer base is focused on young companies and technology firms. So, the fact it is seeing some early green shoots of recovery among its clients could be good news not only for Brex but for many companies and investors in this world.

"Lots of companies are getting to the point where they can't cut spending any more and some are starting to return to growth," Brex Chief Financial Officer Ben Gammell told me recently.

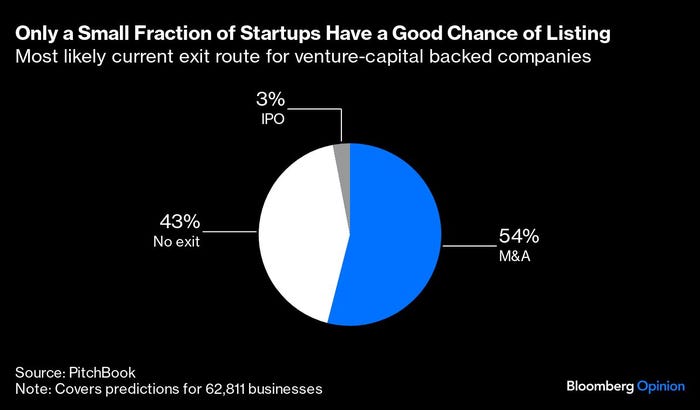

There have been promising signs of a thaw for venture capital in fundraising and some new stock market listings, too. Still, plenty of portfolio companies remain zombies that were either absurdly overvalued at the peak or never should have got investment in the first place. Only 3% of nearly 63,000 VC-owned companies globally are on track for a successful exit via an initial public offering, according to an exit prediction model from PitchBook, a data and research firm owned by Morningstar Inc. About half of those startups are more likely to be sold to another company or investment fund, while 43% currently don't have a likely exit, according to the model, which is based on a string of indicators including the timing and size of fundraisings, the number of investors, founders and employees, company locations and valuations.

Most startups have had to pivot hard to hunkering down and focusing on costs over the past 18 months or so, Brex included. The sharp interest-rate increases of 2022 put a chill on venture capital funding. Companies suddenly had to cut back spending to survive and sacrifice growth in favor of trying to reach profitability if they could.

Brex ended up cutting about 20% of its staff in February this year, taking out about one-third of its salary costs, as part of its own spending slowdown. Gammell says the exercise was as much about speeding up decision making as expenses.

Brex was hit hard because its founding product depends directly on spending by startups: It launched in 2017 as a credit-card issuer for companies without enough trading history for traditional banks to take them on. Brex quickly moved beyond that simple model by adding deposits accounts and developing expense management software, which offer more stable licensing revenue. But one of its main income streams is still the interchange fees that come every time a card is used.

The company's client roster now includes larger businesses, including such as Shein Group Ltd. and DoorDash Inc., as well as startups, but most skew toward the tech industry. Small and large tech companies have similar needs and operate in similar ways, Gammell says, while traditional small and medium-sized companies are often very different.

If this narrow focus seems a risky strategy, it isn't uncommon. Gammell says a lot of software and other tech companies in Silicon Valley do business with each other partly because of geography — it's natural to sell first to your neighbors — and partly for cultural reasons. "People that work at tech companies are more likely to be early adopters of other technology, too," he says.

Neighbors also copy each other's ideas and compete. While finance startups like Brex have been developing enterprise software, software companies have increasingly been trying to embed payments services and other finance tools into their products. Toast Inc. is a good example of this: It began as software and systems for managing restaurants and added payments services and even a Toast Capital lending arm. It's growing rapidly but has yet to report a full-year profit since listing in New York in 2021.

Brex also benefited from Silicon Valley Bank's collapse last year. Like several other fintechs and big banks, it won a rush of new customers: Gammell says assets under management went up 50% the weekend of SVB's failure. Initially, Brex expected many of these customers might move on to bigger banks, like JPMorgan Chase & Co. if they were able to open accounts, but in fact they've mostly stayed. "A lot of customers use us as an operating account, and maybe they go to JPMorgan or whoever for traditional treasury services or other things," Gammell says.

Brex expects to reach breakeven itself in 18 months to two years. It could get there faster if it wanted, Gammell says, but having raised a lot of money in 2021 and 2022 it can still invest in marketing for growth even if it needs to keep a bit more of an eye on cash flow than before. According to PitchBook, Brex got about $800 million in funding in a two-part series D round.

The company doesn't lend money to clients through its credit cards — balances must be cleared every 30 days. But it has to fund that short-term float and has added a securitization program to its bank facilities.

All this means Brex can afford to wait to test its valuation in another investment round or even an IPO, which is lucky given the steep falls suffered by many fintechs since 2022, including multibillion-dollar unicorns like Klarna Bank AB and Stripe Inc.

There have been signs of recovery in the sector. Ramp, a direct rival to Brex, just last month raised $150 million in new series D funding at a $7.7 billion valuation, which is down from its $8.1 billion peak, but up from $5.8 billion in its previous round in summer 2023, according to PitchBook. In the UK, a consumer-focused fintech, Monzo Bank Ltd., also got a fresh investment this year at a better valuation than its 2021 round, according to Bloomberg News.

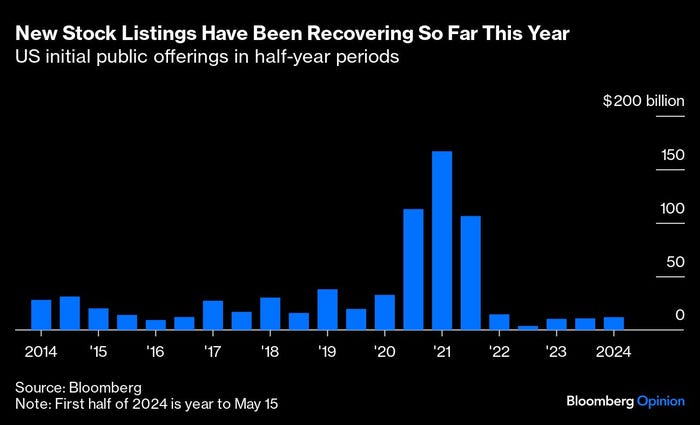

The IPO market is also loosening up: Investors even backed a lossmaking tech startup last month in the shape of Rubrik Inc., a Palo Alto, California-based data storage company that's pivoting to cyber security, and which now trades about 8% above its $32 a share listing price.

US IPO volumes so far this year already exceed those in the full first half of 2023, although that's not hard. Plenty of companies are waiting for their chance to list — and allow their VC backers to hand cash to their impatient investors. The surviving part of SVB, now owned by First Citizens BancShares Inc., has a record number of exit-ready companies poised to hit the IPO market, Chief Executive Officer Frank Holding said on the bank's recent earnings call.

The chances of Brex or Ramp investors eventually exiting through an IPO are more than 90%, according to PitchBook's prediction model, although that doesn't mean they're poised to list soon. Gammell says going public might be a great experience, but it comes with costs, so you need a good reason.

The picture for startups might be brightening, but markets remain fragile, and many VC funds are under pressure to sell companies before they can start raising fresh money themselves. Any business that can keep building on its own should probably keep doing that as long as possible

Read more about:

Financial ServicesAbout the Author(s)

You May Also Like